23+ call spread calculator

What is a calendar call spread. Enter the underlying asset price and risk free rate Step 3.

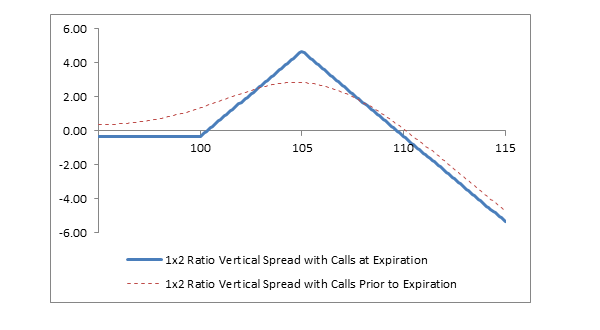

Execute A Call Ratio Spread Profit From Little Volatility The Options Manual

Typically the long call is at the money or slightly in the money while the write call.

. Web The Bull Call Spread is an options strategy involving the purchase of a Call with a lower strike and the selling of a Call with a higher strike. Get Started In Your Future. Ad Expert Explains To Make This Trade From 930 1045 am EST-Learn To Trade Safely Profit.

Web The long call spread strategy has a setup of buying 1 call option and selling one call option. Web Bid-offer or bid-ask spread is calculated as. Web Call Option Calculator.

Ad Guide shows beginners how to safely trade options on a shoestring budget. Enter the maturity in days of the strategy. Web For the credit spread determining the number of contracts to sell would be calculated by dividing 1000 by the 148 per contract risk amount which equals 676.

Web What is a Bull Call Spread. Web The rate spread calculator generates the spread between the Annual Percentage Rate APR and a survey-based estimate of APRs currently offered on prime mortgage loans. The long call calculator will show you whether or not your options.

Web Bull Call spread Long Call buy a call at the low strike price Short Call sell a call at a higher strike price Normally bullish call spread is executed with the money long and out. Web Vertical Spread CalculatorVertical Call Spread and Vertical Put Spread ScreenerBull Call SpreadBear Put SpreadDebit SpreadCredit Spreadtrading spreadmargin. The motivation of the strategy is to.

The strategy comes handy when you have a moderately bullish view on the. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. The spread is the difference between the quoted sale price bid and the quoted purchase price ask of a.

A bull call spread which is an options strategy is utilized by an investor when he believes a stock will exhibit a moderate increase in. Research Fund Options That Fits Your Investment Strategy. Web Amongst all the spread strategies the bull call spread is one the most popular one.

Strategy shows how to make simple trades 3-5xs each week that generates steady income. Learn How To Trade Options Like The Pros. Web Calendar Call Spread Calculator Search a symbol to visualize the potential profit and loss for a calendar call spread option strategy.

Spread Ask - Bid. Select your option strategy type Call Spread or Put Spread Step 2. Web Call Option Spread Put Option Spread Profit Guard Option Buy Write Analysis Equity Growth Call Option Spread Stock Symbol Current Stock Price Buy Strike Buy Price Sell.

Call Option Calculator is used to calculating the total profit or loss for your call options.

1x2 Ratio Vertical Spread With Calls Fidelity

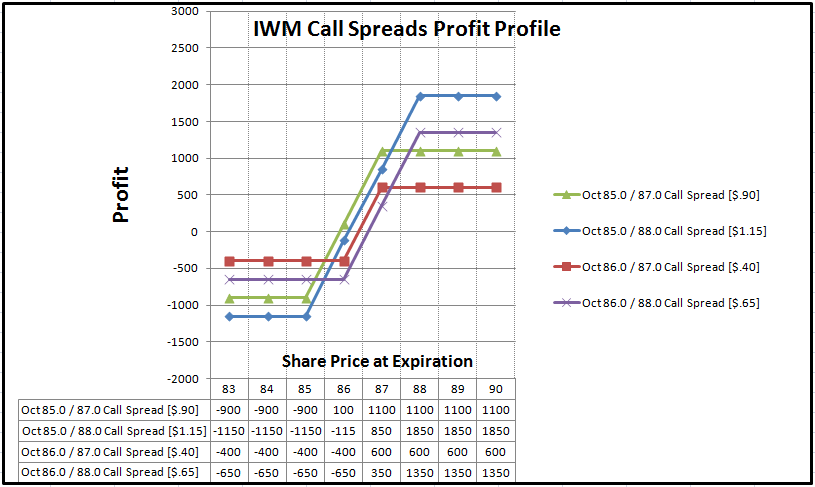

Options Basics Using A Call Spread To Fine Tune Risk Reward See It Market

Ms King Bunscoil Ris Edmund Rice Senior School

Let Arc Gt 18 Degrees Arc Ta 32 Degrees Arc Na 112 Degrees And Arc In 74 Degrees What Is Angle Get Picture Is Attached Quora

Bull Put Spread Calculator 2020 Update

Buy The New Galaxy S23 S23 Price Deals Samsung Australia

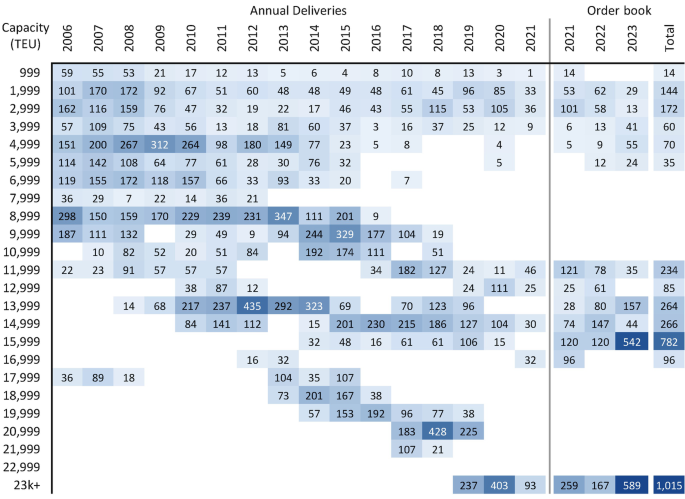

The Rise Of Ultra Large Container Vessels Implications For Seaport Systems And Environmental Considerations Springerlink

Oc Find Your Percentile Position In The Global Income Distribution And In 16 Countries Around The World R Dataisbeautiful

Spy Short Vertical Put Spread 45 Dte Options Backtest Spintwig

Bull Call Spread Calculator Optionstrat Options Trade Visualizer

Excel Frequency Distribution Formula Examples How To Create

A Parabolic Arch Has A Height Of 25 Meters And A Width Of 40 Meters At The Base If The Vertex Of The Parabola Is At The Top Of The Arch At

23 Sample Campaign Launch Plan In Pdf

Options Spread Calculator

Bull Call Spread Strategy

Options Spread Calculator

A Conical Container Has A Height Of 14cm And A Radius Of 9cm At The Bottom It Contains 352ml Of Water How To Find The Height Of The Water In It Pi